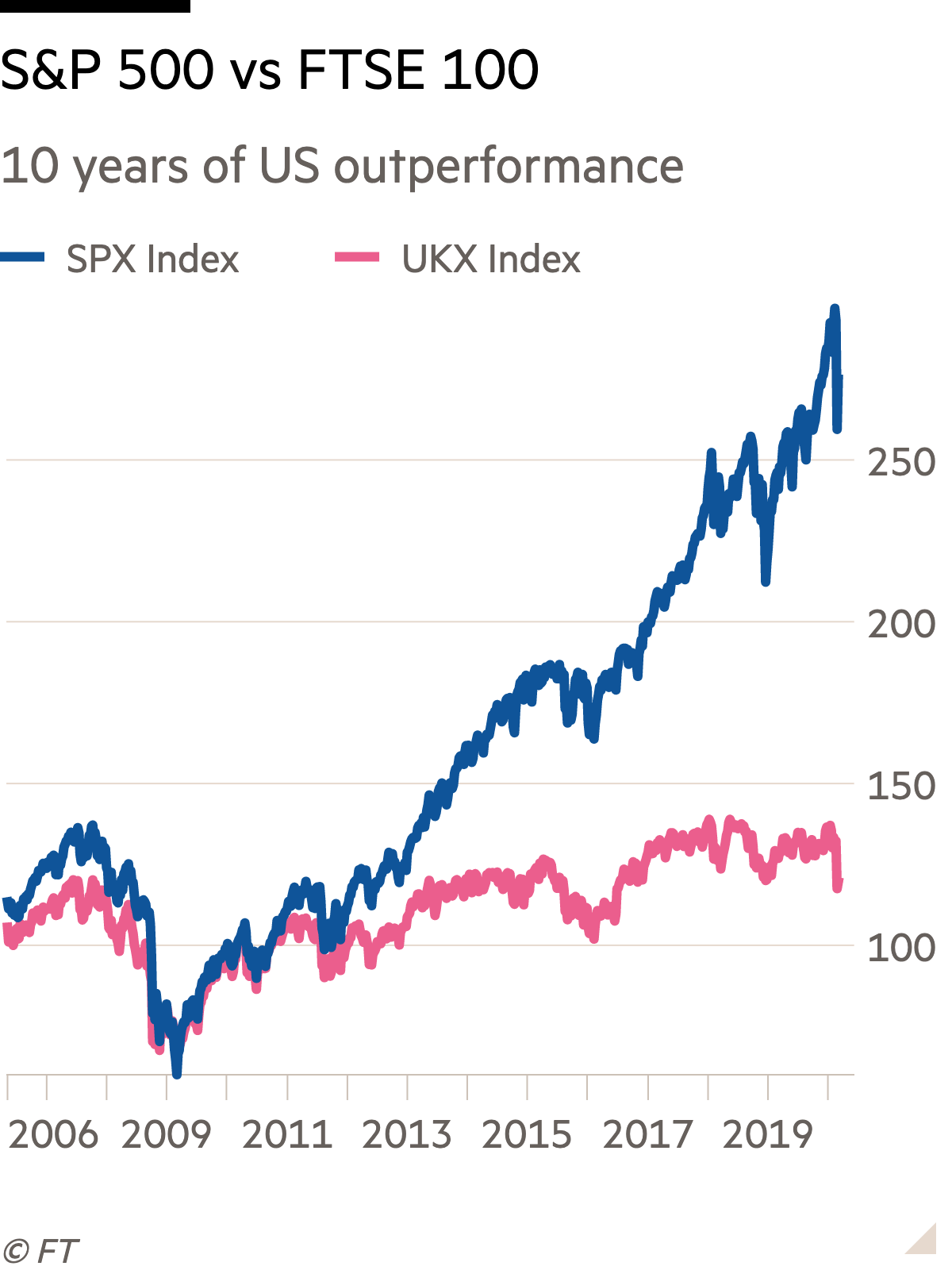

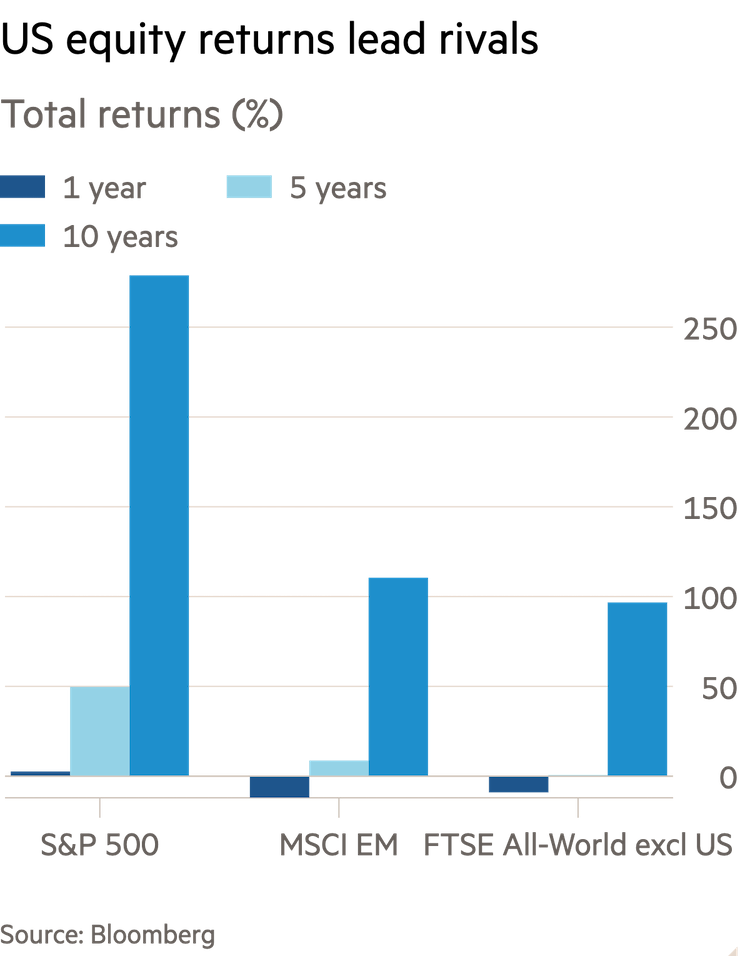

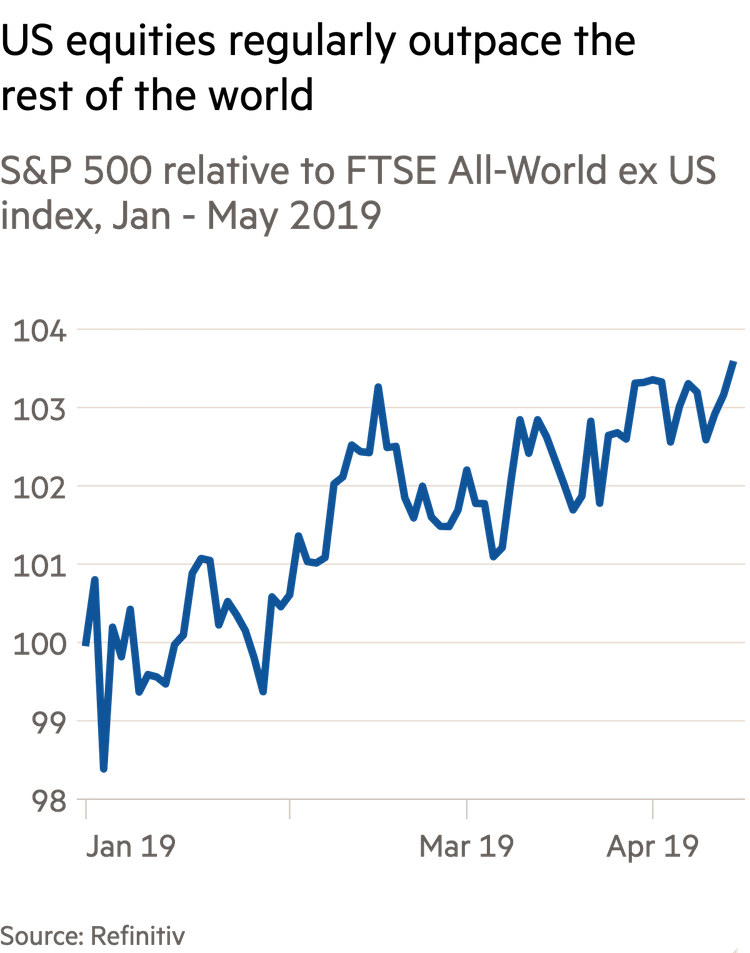

The US stock market is unquestionably exciting. It has supported the meteoric rise of companies which have changed the way we live – Amazon, Netflix and Apple, for example. It has spawned celebrities and excellent films. In the last five years, the value of the S&P 500 (the 500 largest companies in the US) has almost tripled.

For context, the FTSE 100 – the UK’s equivalent large company index – has delivered growth of just 27% in the same time. No one’s making films about that kind of ordinary performance. UK investors who neglect international equities risk missing out on excellent returns.

What is the US stock market?

The US stock market is home to an enormous collection of companies. In fact, it’s so big, it accounts for just under half of global equity value and is five times the size of its closest competitor.

That size is reflected in the companies listed on various exchanges: four different companies have been valued at more than $1trn at one point; Apple has enough cash to buy all but one British company.

Components of the US stock market

There are two main exchanges in the US on which companies can list. The New York Stock Exchange boasts a total value of roughly $30trn and is the largest stock exchange in the world by some margin.

Nasdaq was founded in 1971 as the world’s first electronic stock market – unlike its older brother, there is no need for traders to be present on the floor of the stock exchange. Generally, the Nasdaq welcomes innovative, tech companies.

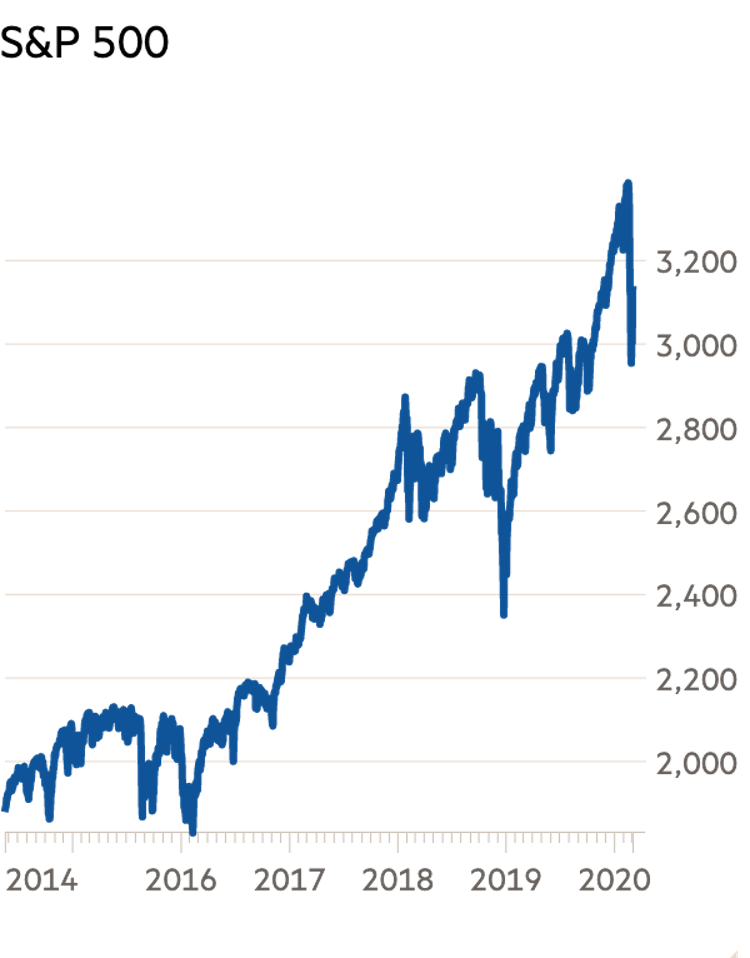

There are also two main indices which are often used to illustrate the performance of the US stock market. The S&P 500 index tracks the performance of the 500 largest companies in the US.

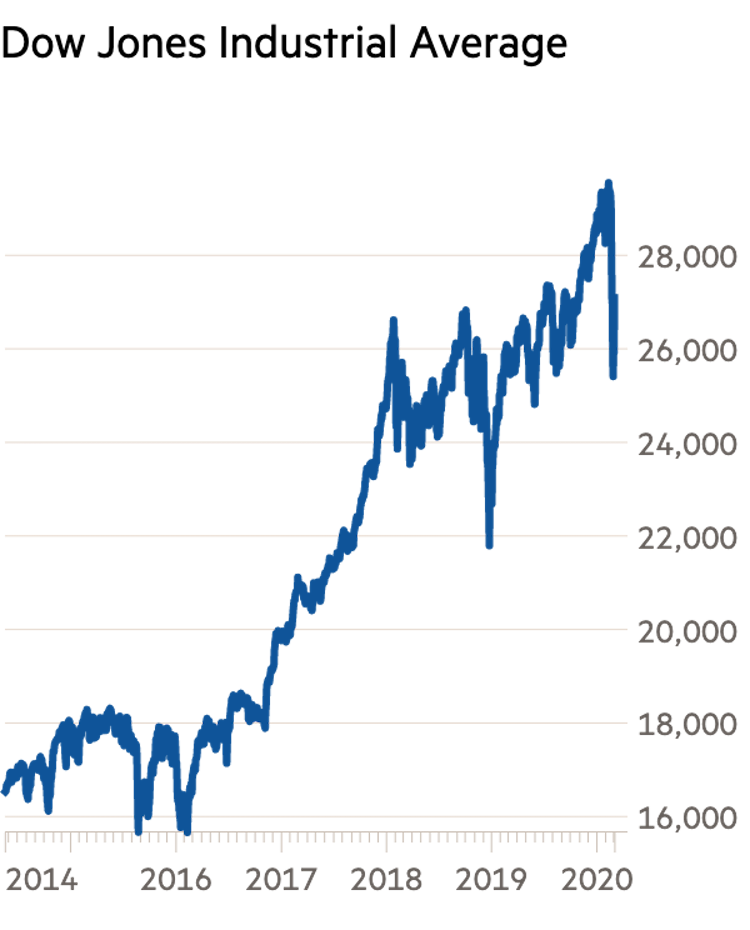

The Dow Jones Industrial Average, is a stock market index that measures the stock performance of 30 large companies listed in the US.

US-listed companies

Companies listed in the US include household names and tech giants, innovative biotechs and mining companies, manufacturers and car companies.

Apple (US: AAPL) - Long time holder of the title, ‘the world’s largest company’, Apple has had a fascinating 40 years on the New York Stock Exchange. Perhaps best known for its iPhone and its enigmatic founder Steve Jobs, investors love it for its amazing profits and incredible capacity to generate

Walmart (US: WMT) - Few brands symbolise the ‘American corporate’ better than Sam Walton’s supermarket giant – the biggest retailer in the world. Today Walmart runs 11,503 stores across 27 countries, operating under 55 different brands.

Why does the us stock market matter to me?

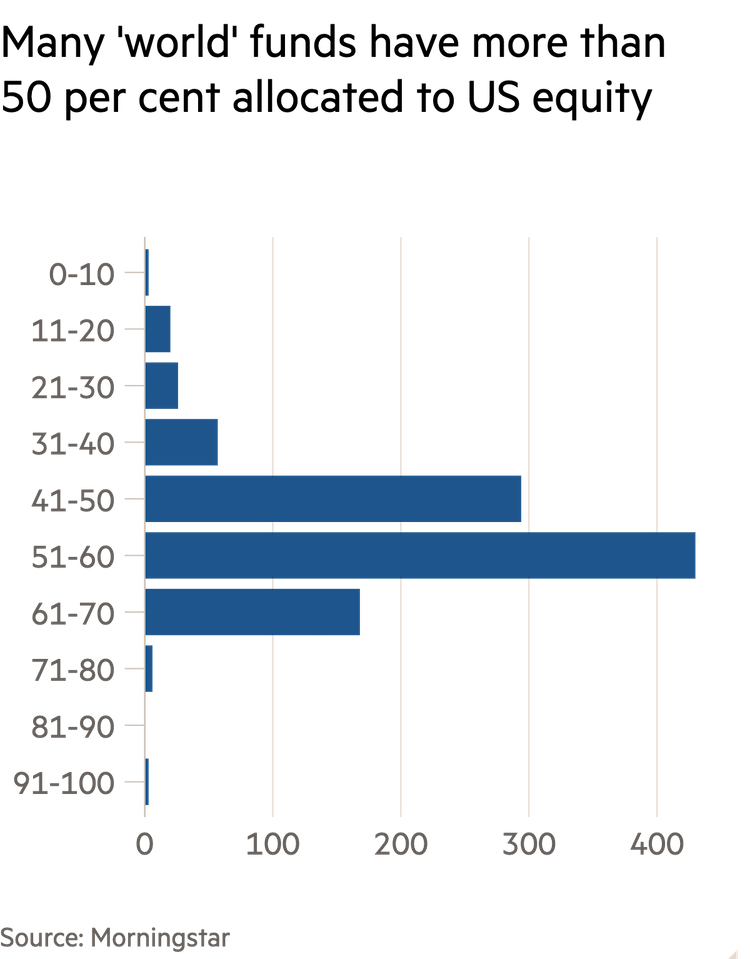

UK investors are probably already invested in the US stock market as most pension schemes have some US exposure. That is a good thing because avoiding the US means investors are missing out on the biggest and best performing companies in the world. The breadth and depth of investment opportunities in the US is unrivalled by any other global stock market. What’s more, most of us are customers of the biggest US companies, we can benefit from being investors as well.

Don’t let irrational fears prevent you from benefiting from the superior gains of the US stock market

It’s true, investing in the US hasn’t always been simple, or cheap. But developments in the last few years have changed that:

- 2014: The IRS simplifies the W-8BEN form which ensures foreign investors are except from the 30% tax paid on income from US shares

- May 2017: Vanguard launches in the UK offering British investors access to cheap tracker funds

- January 2020: IG removes its trading costs for US shares

- February 2020: Investors Chronicle launches its new international feature series ‘The world’s hottest shares’ with an in-depth look at Tesla

- ‘Early 2020’: Robinhood launches in the UK offering UK shareholders no commission or FX charges

Myth-busting

“The tax situation is complicated”

It's true, the tax situation is different in the US. But as long as you complete your W-8BEN form, you shouldn't have to worry about it.

“Investment platforms charge a lot to invest in US shares and funds”

Not all of them do. For example, Vanguard offers a fund which tracks the S&P 500 at a charge of 0.01%.

“I don’t understand US companies”

US companies file their accounts in a different way to British ones. For example, they report numbers every quarter, rather than every half year. But their accounts are often much easier to understand then their British counterparts.

step-by-step guide to investing in the US

1. Get going by choosing a platform

First off, investors must choose an online platform, broker or investment manager which offers US stocks and funds. These platforms vary in user-friendliness and price. Most permit investment via an ISA, others offer SIPPs. It’s best to hunt around to find a platform which suits your own personal needs.When you're getting going, remember to consider:

- Are you planning on picking stocks yourself or funds?

- How much trading are planning on doing?

- How much do you want to invest in the US stock market?

TIP: If you are going to be buying and shares regularly, chose a platform with cheap trading and FX costs because you have to pay these fees at each transaction pay these fees at each transaction

2. Complete a W-8BEN form

Brit’s can’t buy US shares without first completing a W-8BEN form. Many online platforms including Hargreaves Lansdown, IG and AJ Bell, can process the forms for you if you fill in the forms on their websites.

These forms ensure you enjoy your 30% reduction in the amount of US tax you’re charged on the income you make from US company dividends.

3. Decide whether you want to buy individual stocks or funds

Just like in the UK, investors can pick their own stocks or buy funds. Stock picking in the US is fun, largely thanks to the huge array of incredibly high quality companies on offer. There are plenty of specialist US fund managers and advisers based in the UK, which can build a portfolio for you. Alternatively, US index trackers are among the cheapest and best performing investment options available.

Considerations:

- How big is your portfolio?

- How much time do you have to invest in picking your investments?

TIP: If you want to keep your US investing as simple as possible, you can buy a passive fund which simply tracks the US market via a cheap platform like Vanguard.

4. Chose the US shares and funds you want to buy

A subscription to the Investor’s Chronicle can help you pick the stocks and funds which will help you beat the market.

FAQs

What are the tax implications of buying US shares?

Investments in the US are not subject to capital gains tax, but they will be taxed in your home country.

Do I have to pay more tax on income from US shares?

Non-residents are subject to a dividend tax rate of 30%. But as long as you complete your W-8BEN form, you will be excluded from that tax.

Are foreign exchange fees expensive?

Yes, if you keep switching your money from dollars to sterling and back again. To keep the costs down, try not to convert your money backwards and forwards too often. As investments tend to perform better if over the long run, you can avoid repetitive FX fees by simply keeping your money in dollars. Even if you sell your shares, it’s best to keep the cash in your dollars in case you want to buy something else.

Is it too risky to pick your own stocks?

Stock picking does require more time and effort than simply buying passive funds or employing a fund manager. It is only recommended if you have a large enough portfolio and enough time to research properly.